Financial

In 2023, AutoStore demonstrated the resilience of its business model.

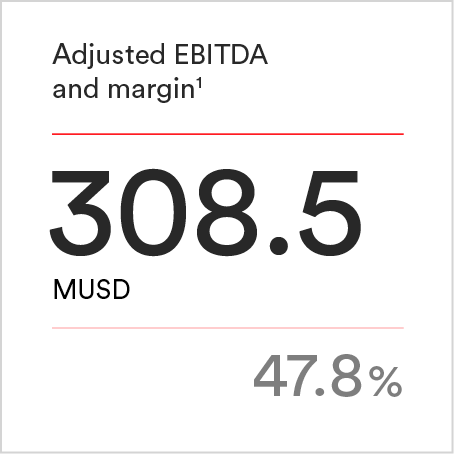

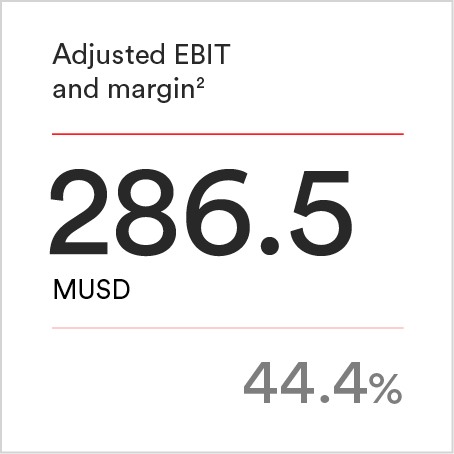

Despite market uncertainty, AutoStore delivered revenues of USD 645.7 million, representing a 10.6% year-over-year revenue growth and a robust adjusted EBITDA margin of 47.8%. In 2023, continued inflation globally drove caution amongst decision makers and longer processes to commit capital investment to new projects. This was seen in automation too, with customers taking longer to activate supply chain modernization. However, automation remained a priority for businesses with 9 in 10 companies interviewed by Deloitte in 2023 investing in supply chain and operational excellence (1). Through the AutoStore partner and global account model, the company continued to harness and support this demand with a strong sales pipeline of approximately USD 6.5 billion and an order backlog of USD 447 million, providing strong foundations for growth into 2024.

Margins continued to improve in 2023 with a focus on further developing lean and efficient operations including refined production and sourcing strategies. AutoStore expects to maintain high margins in 2024. The highly standardized nature of AutoStore products, highly effective go-to-market model, a more diversified supplier network and a new facility in Thailand all contribute to efficiencies and shorter and more reliable lead times for customers going into 2024.

The decrease in reported EBITDA in 2023 can be attributed to the settlement of the patent dispute with Ocado Group in the second quarter of the year with a settlement payment of GBP 200 million and associated litigation costs. The settlement of the dispute avoids future litigation costs and allows the company to focus on its product development and strategic goals to meet growth targets.

(1) – Deloitte 2023 consumer products industry outlook

(1) – please see APM section for further details

During 2023, AutoStore reviewed progress against the business strategy, and reaffirmed priorities towards 2025 to meet long-term growth and business development goals.

The overall strategic direction remains the same, with the leading aspiration to grow revenue beyond market growth by continuing to capture market share, and to do so whilst maintaining high profit margins.

To meet these ambitious goals, AutoStore has updated its vision to reflect the drive to capture white space in an immature market and grow through new applications and adjacencies. As the engine of every fulfillment operation, AutoStore will target significant growth and wider potential beyond the walls of the cube and the walls of the warehouse.

The vision is supported by the constant mission of AutoStore to save space, time, and energy to make the incredible happen.

Read more about how AutoStore’s reaffirmed priorities

AutoStore recognizes ESG (Environmental, Social, and Governance) management, measurement, and reporting as key to building resilience in all aspects of its business. In 2023, the focus of the company has been on securing a solid foundation on which to build future sustainability efforts. During the year AutoStore developed a ESG governance structure, conducted a double materiality assessment for the first time, worked on improving data quality, and increased the sustainability competency overall in the organization. A process to establish the Sustainability strategy for AutoStore which will lead to target setting and detailing of ambition level was initiated end of year 2023.

This ESG report provides an overview of AutoStore’s initial outlines of the sustainability strategy, policies, impacts, risks and opportunities, and material topics. The aim is to be transparent, balanced, and comprehensive about the state of ESG at AutoStore today, and the company’s direction for the future.

Read more about our ESG initiative here.

Letter from the CEO

Gaining market share

Throughout 2023, AutoStore has focused on strategy and operational excellence to gain share in an underpenetrated market. The result is continued year-over-year revenue growth and a return to historical adjusted EBITDA margins at 47.8%.

2023 was my first full year as CEO at AutoStore and it has been a year where we have made major steps to continue our global growth and improve the quality of our operations. It has been a pleasure to see the company pull together around shared targets and continue to exhibit our values and culture while striving for significant growth. Together we have reached new milestones adding 200 new unique customers, in five new countries with over 10,000 new Robots shipped, all the while returning to high and sustainable profit levels.

Despite another year of macro-economic challenges, worsened by intensified global conflicts and crises, AutoStore has continued to attract business and outgrow the market. Consumer orientated businesses have been more careful with investments in the past 12-24 months, with decision making processes often taking longer. There is however no diminished appetite for automation, with stable demand throughout the period and strong positive signs developing in the wider market towards the end of 2023. AutoStore’s sales pipeline reflects this continued demand with an approximate value of USD 6.5 billion in 2023, and the light automated storage and retrieval system (AS/RS) market itself offering a potential of ~USD 465 billion (1). Order intake accelerated towards the end of the year, contributing to the year-end order backlog of USD 447 million.

This ability to continue to increase our sales despite market headwinds demonstrates the strength of the company’s highly scalable go-to-market model and the dedication of our talented teams. Through our valued partner network, and the work of highly successful sales resources that we continue to invest in within the company, we have stimulated orders for a wide range of verticals and needs including even the largest high throughput (HTP) operations. The standardized, modular design of our world-class technology means AutoStore is the perfect solution to adopt to most cases within the light AS/RS market. In fact, we see many of our customers add multiple systems to their logistics operations, as exemplified in our global strategic partnership created with DHL this year. The results of these strategic developments and the strength of our product has translated to revenue of USD 645.7 million for the year.

At the same time, we have worked systematically and relentlessly to strengthen our margins and return them to historical levels whilst maintaining a strong return on investment (ROI) for customers. In 2023, our gross margin rebounded to 67.8 percent, almost 10 percentage points higher than in 2022, and our Adjusted EBITDA margin grew to 47.8%. At the same time ROI has remained high for our customers, with a recent targeted study on a select group of customer sites demonstrating a payback period of around 18 months and offering an ROI of 79% within 3 years (2). The key to this has been our standardized product set, enhanced production, and disciplined resource allocation. Operational excellence and ensuring top-class service for our customers has nevertheless remained a top priority. That has meant reducing lead times to enable swift implementation, improving product availability and order visibility, and offering more touchpoints with partners and customers.

Our customers expect us to continue to develop groundbreaking technology that meets their fulfillment needs. In 2023, we continued to focus on our research and development with the launch of 5 new products and ongoing updates to AutoStore software including Router™, XHandler™, Unify Analytics™ and Qubit™ Fulfillment Platform that improve performance and user experience. We have had a particular focus on strengthening our offering for very large high throughput (HTP) systems through these updates and launches. The launch of our latest R5 Pro Robot™ significantly improves performance for large scale, multi-shift e-commerce operations, while updates to the Router™ algorithm have increased throughput for large systems by approximately 10%. These improvements are testament to the company’s drive for innovation to meet customer needs.

Our innovations and technology are protected by a strategic patent portfolio that ensures the exclusivity of our products going forward. During 2023, we settled our patent dispute with Ocado. This impacted our net profits due to settlement costs. However, the settlement has enabled us to resolve all claims and focus on what we do best – developing and selling market leading products.

The future prospects for AutoStore are something that energize me and gives me huge optimism. We are laying the foundations for long-term sustainable growth, to take market share and deliver consistently high margins. At the same time, we are working towards improving our business practices and their impact on people, environment, and society through our developing sustainability strategy. Our vision of being the engine of every fulfillment journey is a goal that drives us, and I look forward to seeing where it takes us in the coming year.

Thank you to all our hard-working employees, partners, customers and to our shareholders for being part of this journey and creating the foundation for the massive potential we have for future success.

Mats Hovland Vikse,

Chief Executive Officer.

(1) - Top tier management consultancy estimates

(2) – Forrester Study 2023